Trusted by Thousands for Reliable Solutions

An income tax notice is an official communication from the income tax department requesting additional information or clarification regarding your tax returns. It may address issues such as discrepancies, missed payments, or additional documentation needed. Understanding the tax notice and responding appropriately is crucial for compliance and to avoid penalties.

Common Triggers for Income Tax Notices include:

Receiving an income tax notice requires prompt action. Here’s what to do:

This process will help you verify and track your notices effectively.

Taking these steps will help you manage the situation effectively and avoid further complications.

Receiving an income tax notice can be a stressful experience, but understanding the types of notices issued by the Income Tax Department (ITD) can help you manage the situation effectively. Here’s a concise overview of each type of income tax notice:

Issued when the ITD needs additional information or documents to complete your income tax return assessment. It aims to clarify details about your tax return.

An income tax notice under Section 139(9) is sent if there are errors or omissions in your filed income tax return. This notice seeks corrections or additional details to rectify the discrepancies.

This income tax notice is issued when the ITD suspects income has been understated or not reported, leading to a reassessment of your income.

An income tax notice under Section 156 demands payment of a tax amount due as determined by an assessment or order. It is essentially a demand notice for collecting outstanding taxes from the taxpayer.

This notice is sent after processing your tax return to confirm whether it has been accepted or if there are any discrepancies.

Issued when the ITD decides to scrutinize your income tax return in detail, usually following an initial assessment notice.

This income tax notice involves adjustment of refunds against pending tax demands. It is used when the ITD adjusts any refunds you are entitled to with your outstanding tax liabilities.

This notice is issued for inquiries or investigations into your income. It allows the ITD to summon individuals or documents to gather information.

Understanding these various types of income tax notices can help you respond effectively and manage your tax obligations with confidence. Always address each notice in a timely manner to avoid additional penalties or issues.

Responding to an IT notice effectively is crucial to ensure compliance and avoid penalties. Here’s a guide on how to handle various types of income tax notices:

Always respond to notices promptly and accurately to avoid penalties and ensure smooth processing.

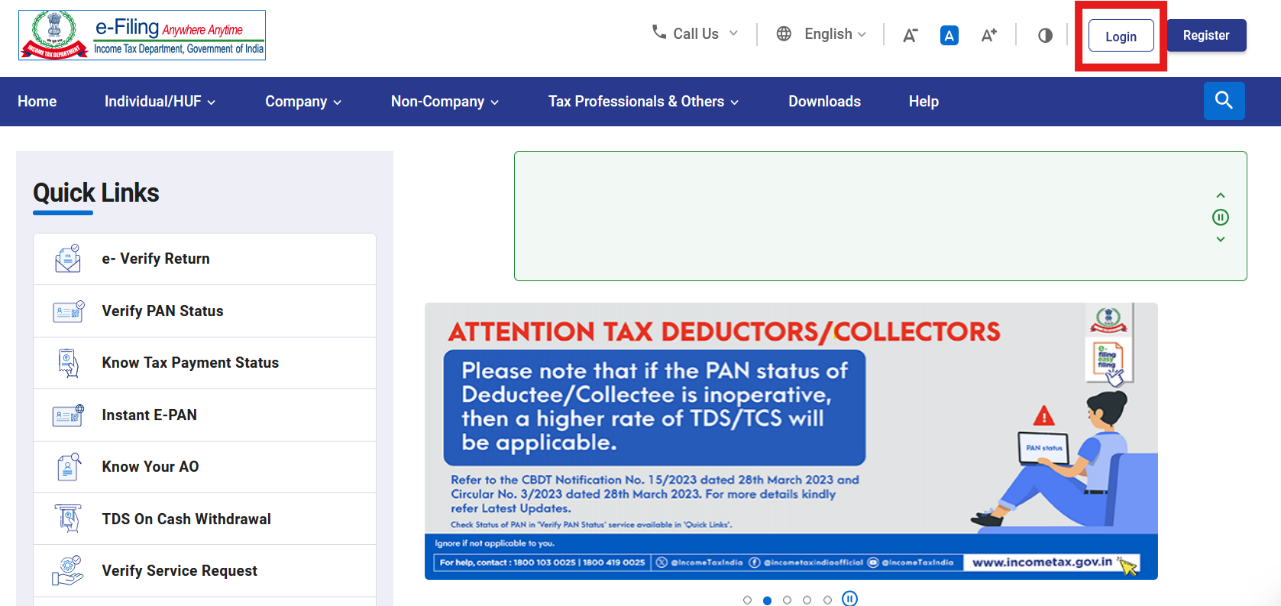

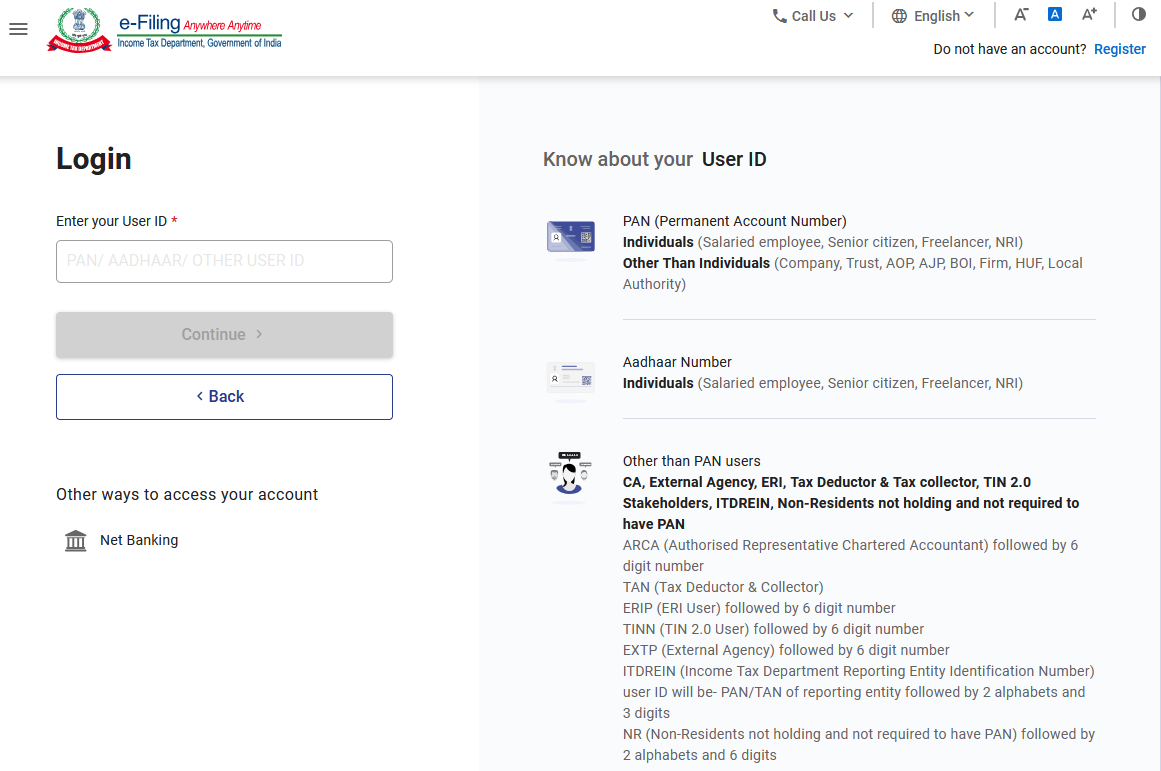

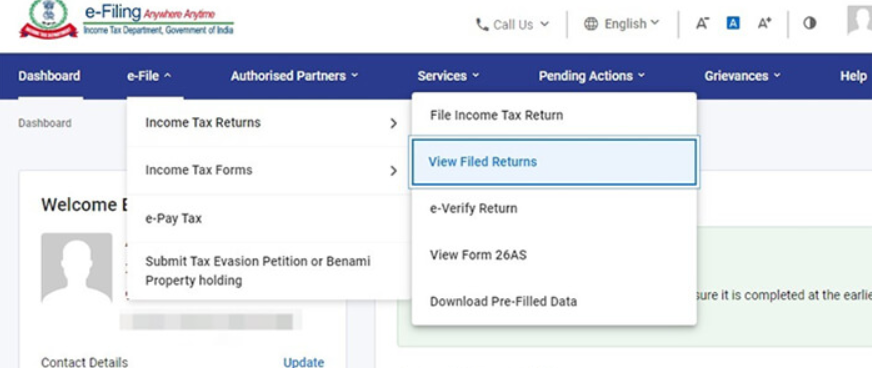

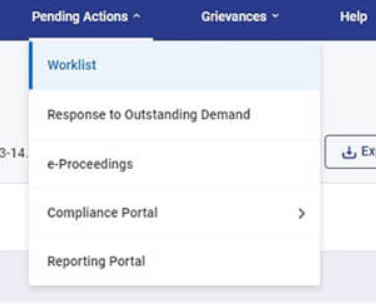

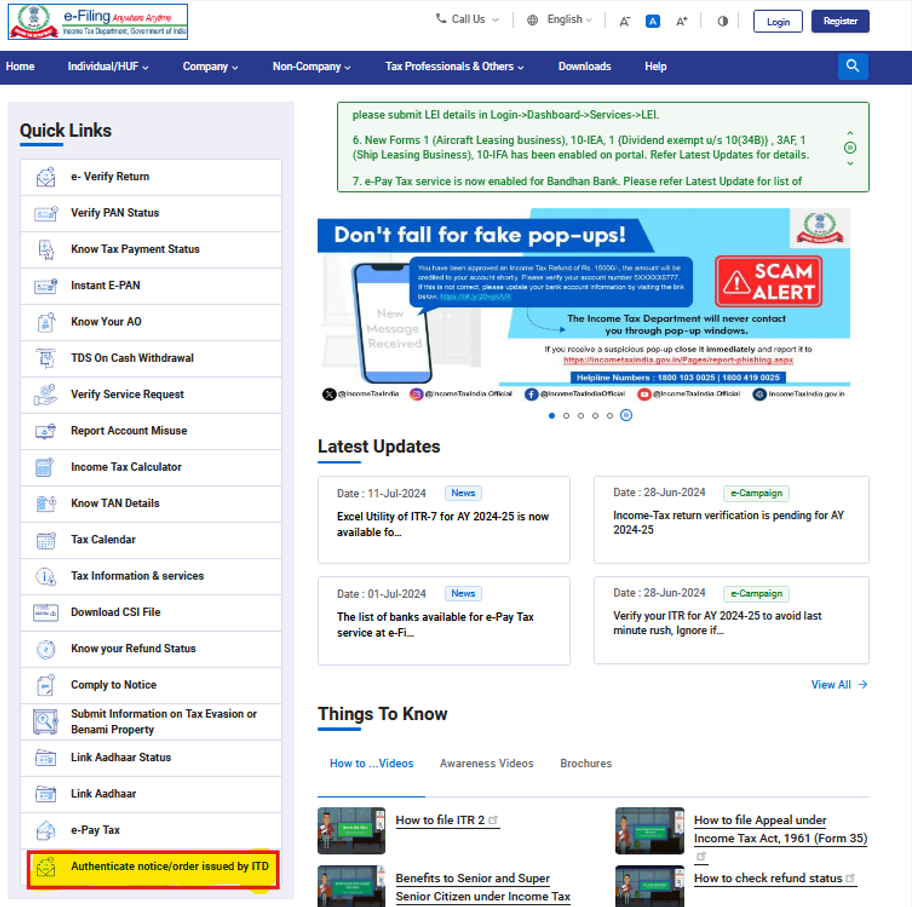

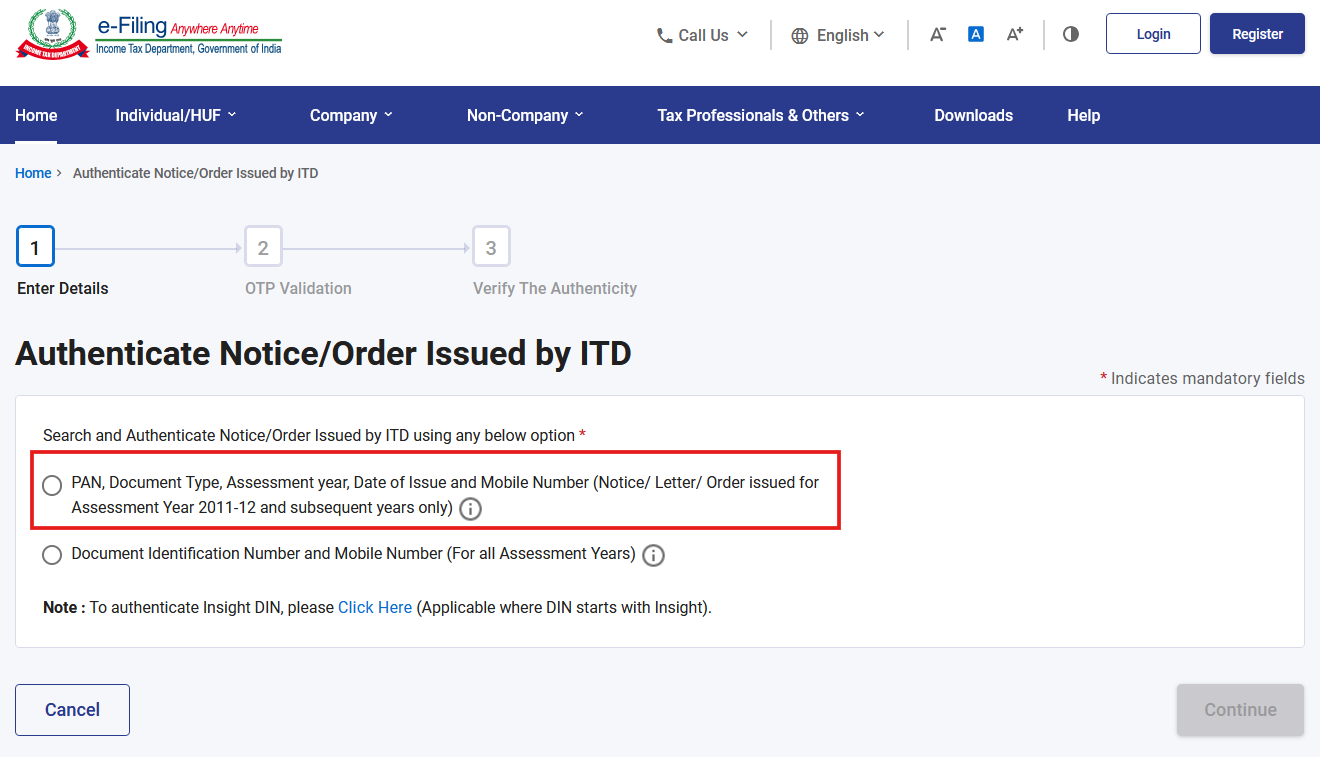

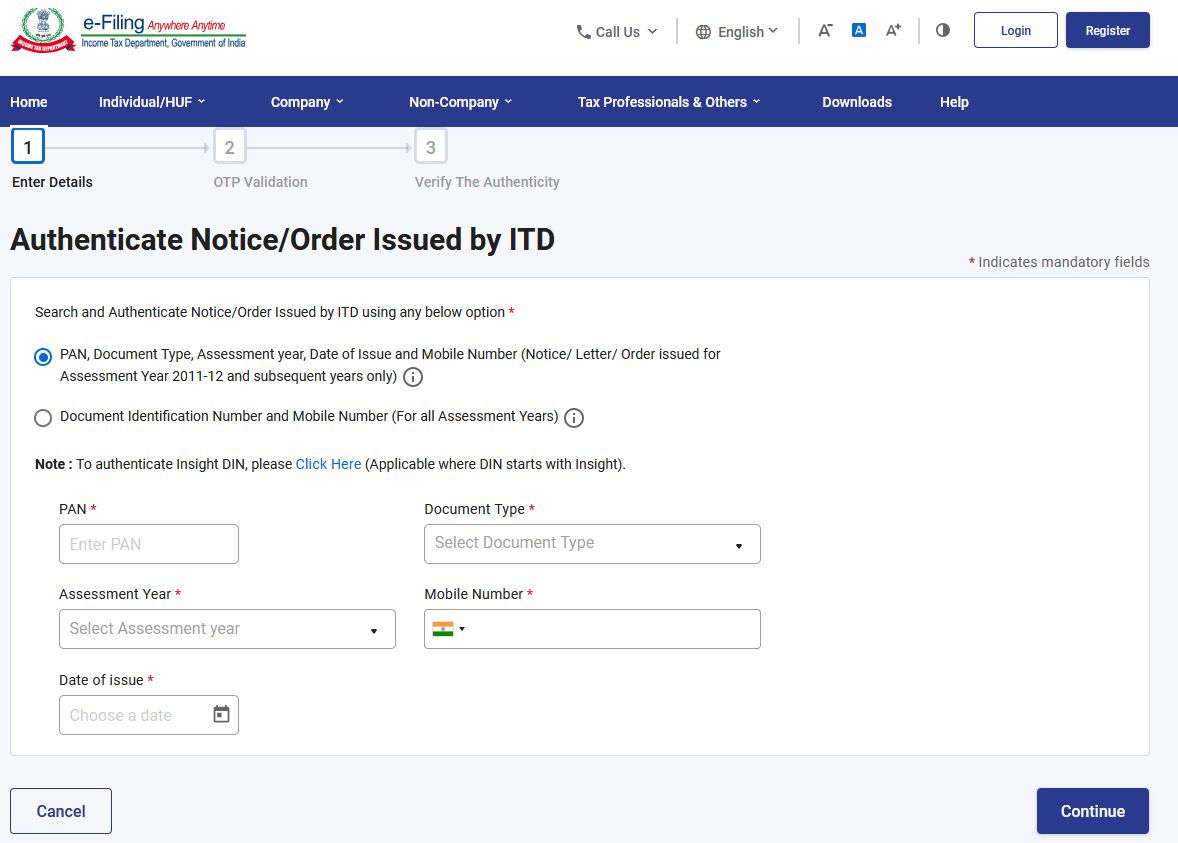

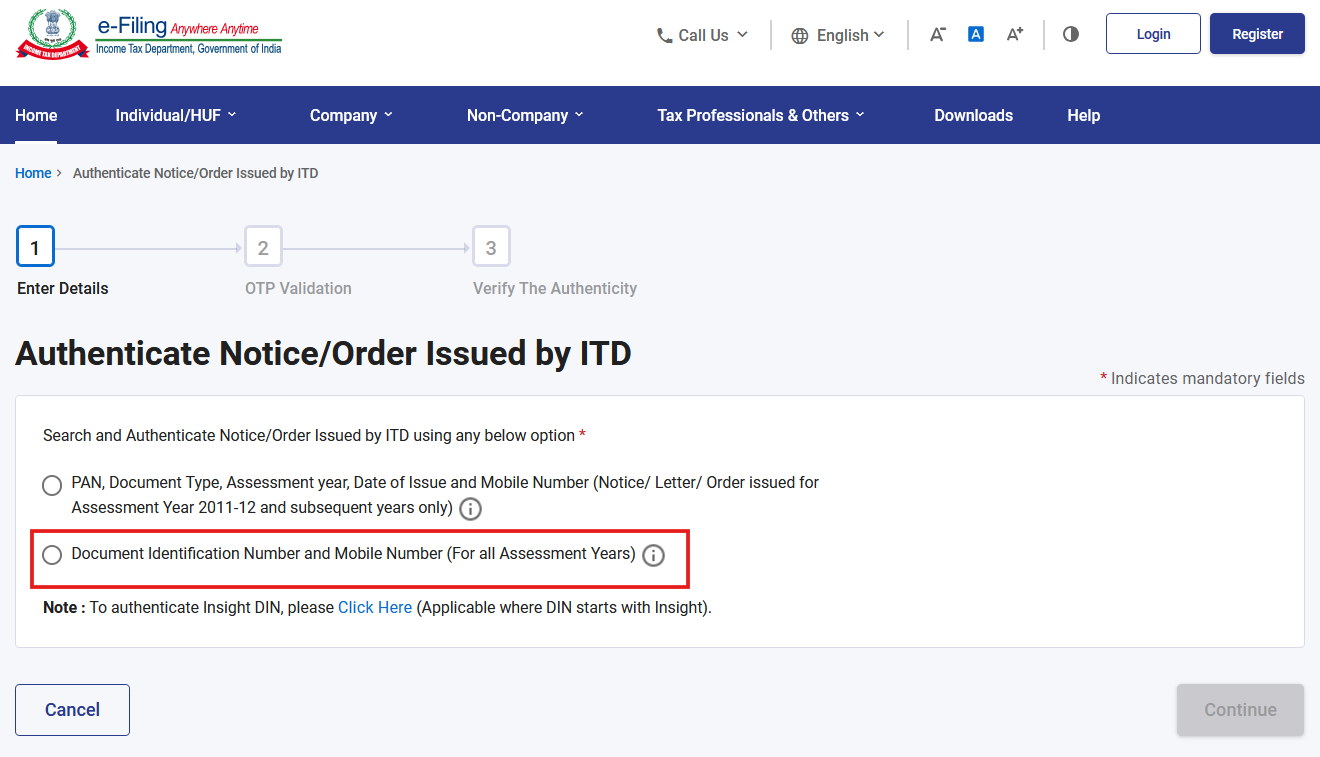

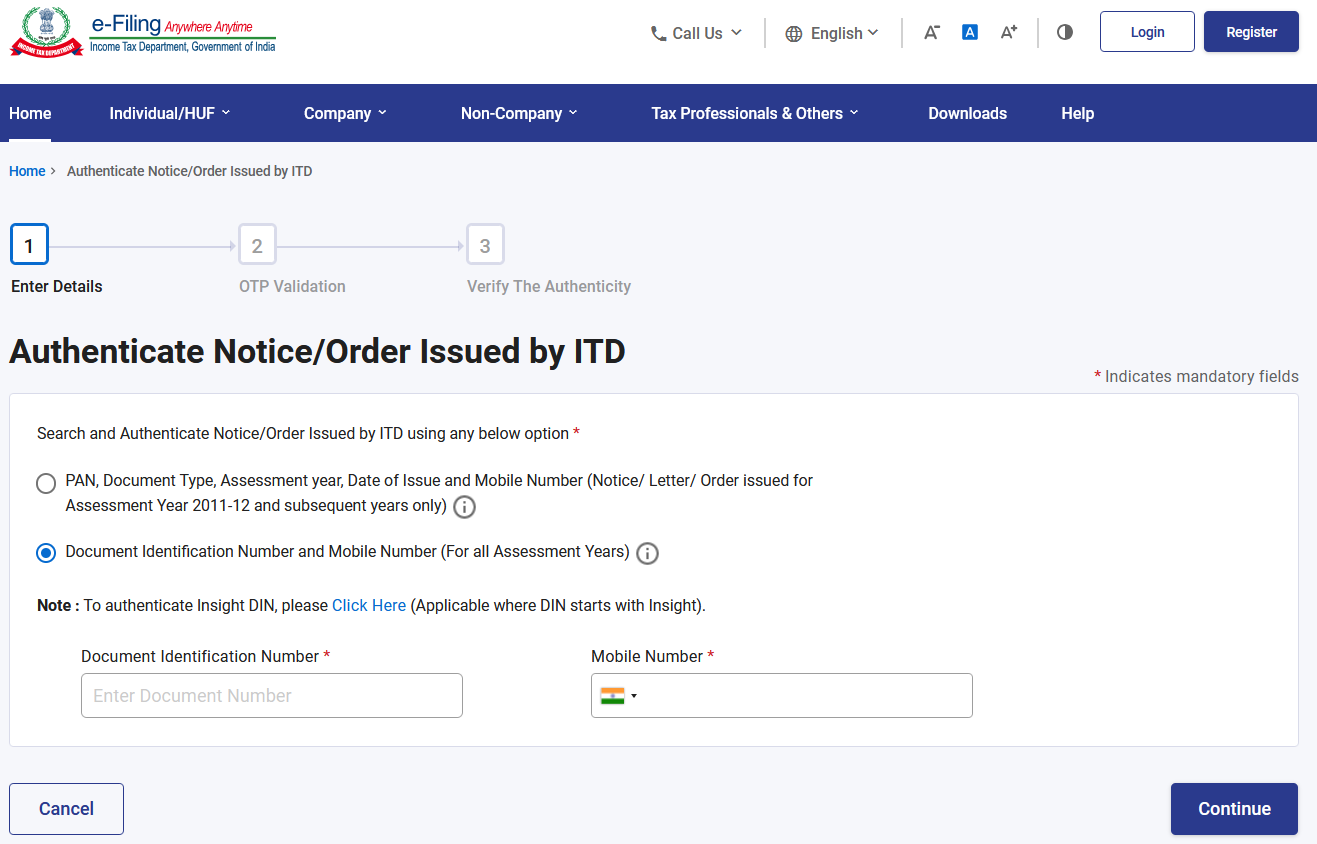

Authenticating an income tax department notice or order is crucial to ensure its legitimacy. Here’s a step-by-step guide on how to verify the authenticity of an income tax notice or order issued by the Income Tax Department (ITD):

To authenticate the notice or order, choose one of the following methods:

If you choose this option:

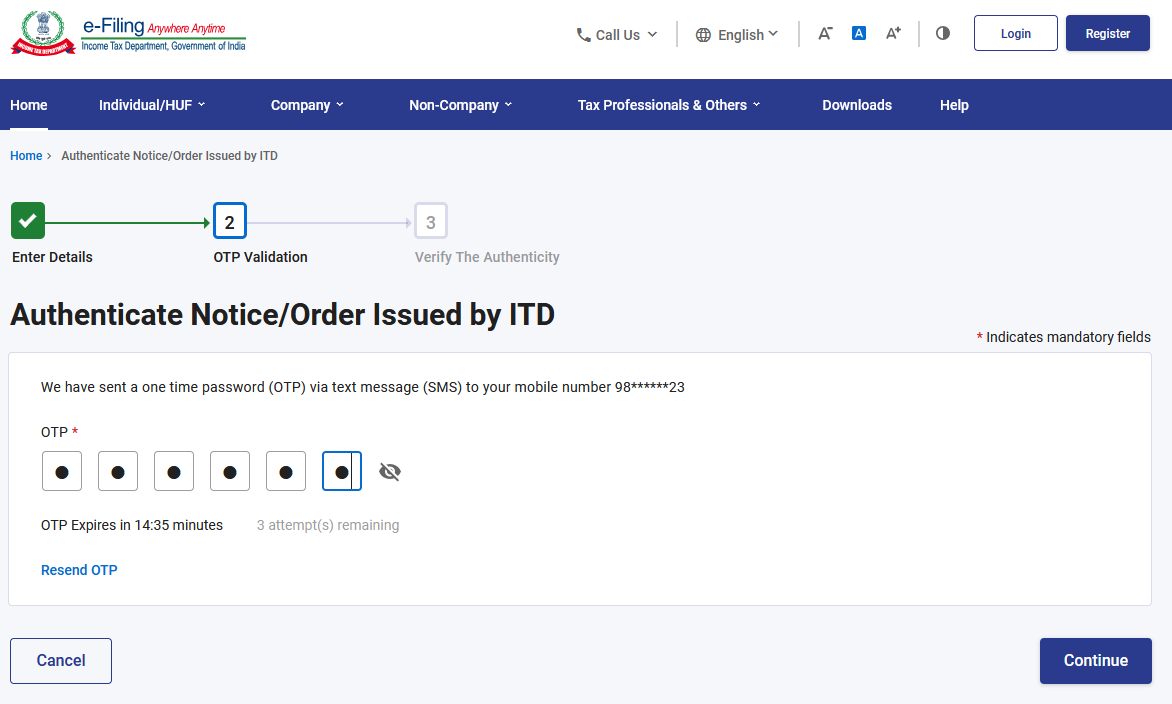

Here are some key points you should keep in mind while you’re in this step:

Once the OTP is successfully validated, the notice's document number and its issuance date will be displayed.

Note: If no notice is found, a message will indicate "No record found for the given criteria.”

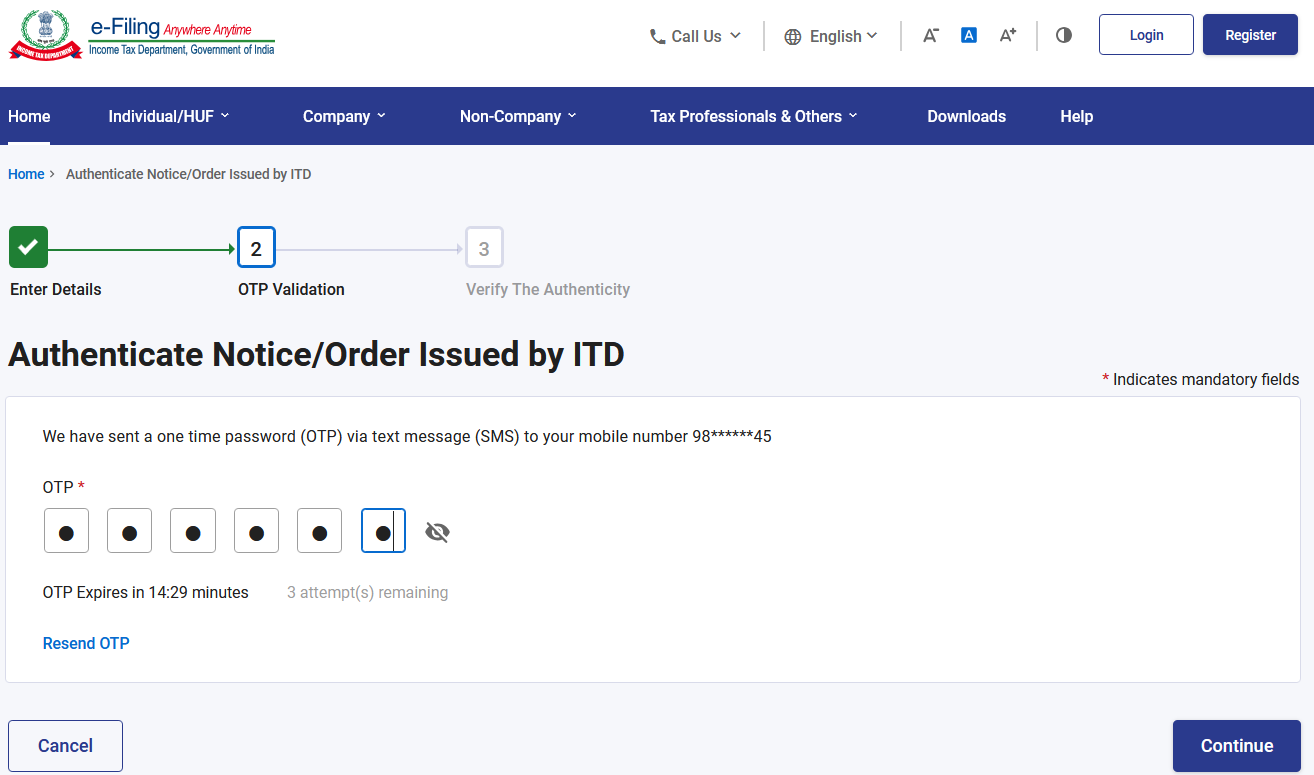

Here are some key points you should keep in mind while you’re in this step:

After validating the OTP, a success message will be shown.

Note: If no notice is found, a message will indicate "No record found for the given criteria.”

By following these steps, you can confidently verify the authenticity of any income tax notice or order issued by the ITD, ensuring its legitimacy and protecting yourself from potential fraud.

Navigating an income tax notice can be challenging, but JJ TAX is here to make it easier.

Ready to turn your tax worries into solutions? Connect withJJ TAX and book a call, chat with an expert, or download our app through JJ TAX for immediate assistance.

You can verify the authenticity of an Income Tax notice by checking the details on the Income Tax Department's official e-Filing portal. Log in to your account, navigate to the 'View Notices/Orders' section, and cross-check the notice details with the information provided in your account.

Common reasons for receiving an Income Tax notice include discrepancies in declared income, significant cash deposits, mismatches between TDS and income declared, non-filing of tax returns, and high-value transactions that do not align with reported income.

Upon receiving an Income Tax notice, carefully read the notice to understand the issue, gather relevant documents, and respond within the specified time frame. It’s advisable to consult a tax professional to ensure accurate and timely responses.

The documents required may vary depending on the notice but generally include your PAN card, bank statements, investment proofs, Form 16, transaction details, and any other relevant financial documents that can support your case.

Professional tax services, such as those offered by JJ TAX, can provide expert guidance on understanding the notice, gathering and organizing necessary documents, drafting a response, and ensuring compliance with all procedural requirements, thereby reducing the risk of penalties or further inquiries.

Income tax notices can be served through several methods:

These methods ensure the income tax department notice reaches the intended recipient.

The documents required vary by the type of income tax notice received. Generally, to reply to an IT notice you will need: