FINANCE: The heart and core of any business. And if we talk about startups, Finance is the life and blood of it.

All entrepreneurs need to raise capital at some point whether to get their business up and running or accelerate growth. But every lending choice comes with advantages and disadvantages.

It's extremely normal to decide to take on some debt, but your financing alternatives will depend on the type of business you have.

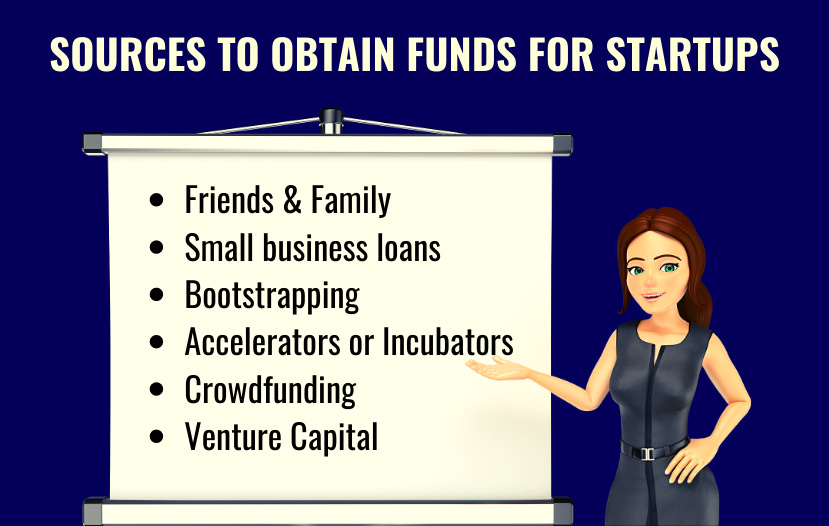

We have outlined a few methods of obtaining finance to simplify your hunt for money and help you find the financing that’s right for your business.

Family and friends

In the early stages of your startup, finding the right funding option can be difficult. Friends and family funding is often the first place you turn to raise some capital. Friends and family funding often takes place on a much less formal basis than bank business loans, angel investments, or even peer-to-peer lending from strangers. Convincing investors or banks of the excellence of your idea may be more difficult, but your family and friends are likely to believe in your goal. They might be more inclined to assist with the funding.

The negative? Borrowing money might alienate friends and sever family ties. If you opt for this route, exercise caution.

Small Business Loans

A small business loan is provided to Small and Medium Businesses to cater to urgent business needs. The Government of India has also launched various loan schemes to benefit Start-up enterprises, SMEs, MSMEs, as well as promote the socio-economic growth of rural India, women entrepreneurs etc.

Some banks specialize in lending to small firms, but banks have generally been wary of lending to small enterprises.

The negative? Qualifying for such loans can be challenging.

Bootstrapping

Bootstrapping is the practice of funding a business from scratch with minimal external capital and is among one of the most prevalent methods of starting a business. This money could be obtained from personal savings, low or no-interest credit cards, or mortgages. Obtaining a free credit report will assist you in determining your financial situation.

The negative? Pressure to immediately generate revenue. This is because revenue is the only sustainable source of funding for such businesses.

Accelerators or Incubators

For early-stage start-ups, accelerators and incubators are a great place to grow their business as they can provide some seed funding besides other resources. Start-up incubators help entrepreneurs refine their business idea and develop strong businesses to expedite profitability and success.

Start-up accelerators take on businesses that already have a solid foundation. So, accelerators focus their guidance and resources to help ventures scale up as quickly as possible.

The negative? Programs can be extremely difficult to get into and the level of commitment required from a founder can be intense.

Crowdfunding

Crowdfunding means gathering small amounts from a large number of investors to raise capital. There are a number of websites that startups can access and interact directly with the crowd to raise funds. Most crowdfunding sites have specific rules. You need to research different crowdfunding sites to understand which platform works best for your business.

The negative? Because many businesses seek crowdfunding, you must build a lot of buzz in order to cut through overall signal noise.

Venture Capital

Venture Capital is a form of private equity and generally comes from financial institutions and other big investors. Venture capital fundings are not easy to obtain. VCs typically invest in startups that are pursuing big opportunities with high growth potential and have already shown some traction in the form of revenue, product prototype

The negative? Depending on the size of the VC firm’s stake in your company, which could be more than 50%, you could lose management control.

Conclusion

There is a plethora of lending options available but the business owners must ask themselves how much financial assistance they really need and which option would be best suitable for them.