Simple ways to make your online transactions safe

Online frauds are on a historic rise these days. One wrong click may land you in a trouble and be the reason of financial loss. Depending on your bank or internet server does not ensure online security; you should take certain safety measures to limit the risk of identity theft or online fraud while performing any online transaction.

No matter, how familiar you are to digital payments, it is essential to ensure security every time you make an online transaction. Basic awareness can help you identify any potential scam and prevent a financial tragedy.

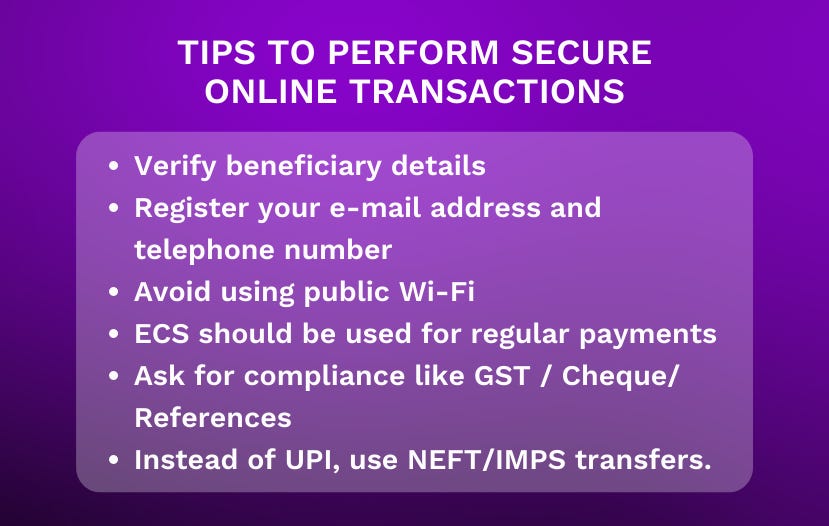

Here are a few ways which will protect you from online frauds:

Verify beneficiary details

To begin an online fund transfer, you must first register the beneficiary(recipient). You are required to provide the beneficiary's name, bank account number, branch name, IFSC code, and daily transaction limit. Verify the information entered before submission, to confirm that there are no errors. Any errors could lead to serious complications.

Register your e-mail address and telephone number

Additionally, you should register your phone number and email address with the bank and activate transaction notifications. This way you’ll be able to track any credits or debits to your account and keep a check on any suspicious transactions.

Avoid using public Wi-Fi

Connecting to public Wi-Fi might expose your phone to hacking and hackers might get access to your private data, and potentially steal your identity and other sensitive data. Therefore, while making any online payment, be sure to do it on a secure private connection.

ECS should be used for regular payments

You can utilize the ECS (Electronic Clearing Service) option to make monthly payments such as utility bills. By using ECS for your mobile bill, for example, the bill amount will be routinely debited from your bank account on a set date, eliminating the need for you to manually initiate a transaction.

Ask for compliance like GST / Cheque/ References

This will provide you with information about the account holder, branch, and account number. There are numerous ways to determine whether or not the account belongs to the same person. Many scammers do not use their personal accounts. This can offer a basis for more questioning and you may catch a scammer.

Final Note

Everyday thousands of people fall prey to online frauds in this digital era. These basic measures can protect you from being a victim of online frauds.