Albert Einstein said “Compound interest is the eighth wonder of the world. He who understands it earns it… he who doesn’t… pays it."

Compounding, i.e., made of two or more separate elements same as compound interest such as Principal & Interest. From Finance point of view, we often think how to get compound interest but first of all let us know about how does compounding effects.

What do we mean by Compound interest?

Interest that is accrued on top of prior interest is called compound interest. Addition of interest to the principal sum of a loan or deposit, or in other words, interest on principal plus interest.

In case of investments, it will have more time to compound if you start out early. The early returns provide higher returns since they are reinvested for a longer period.

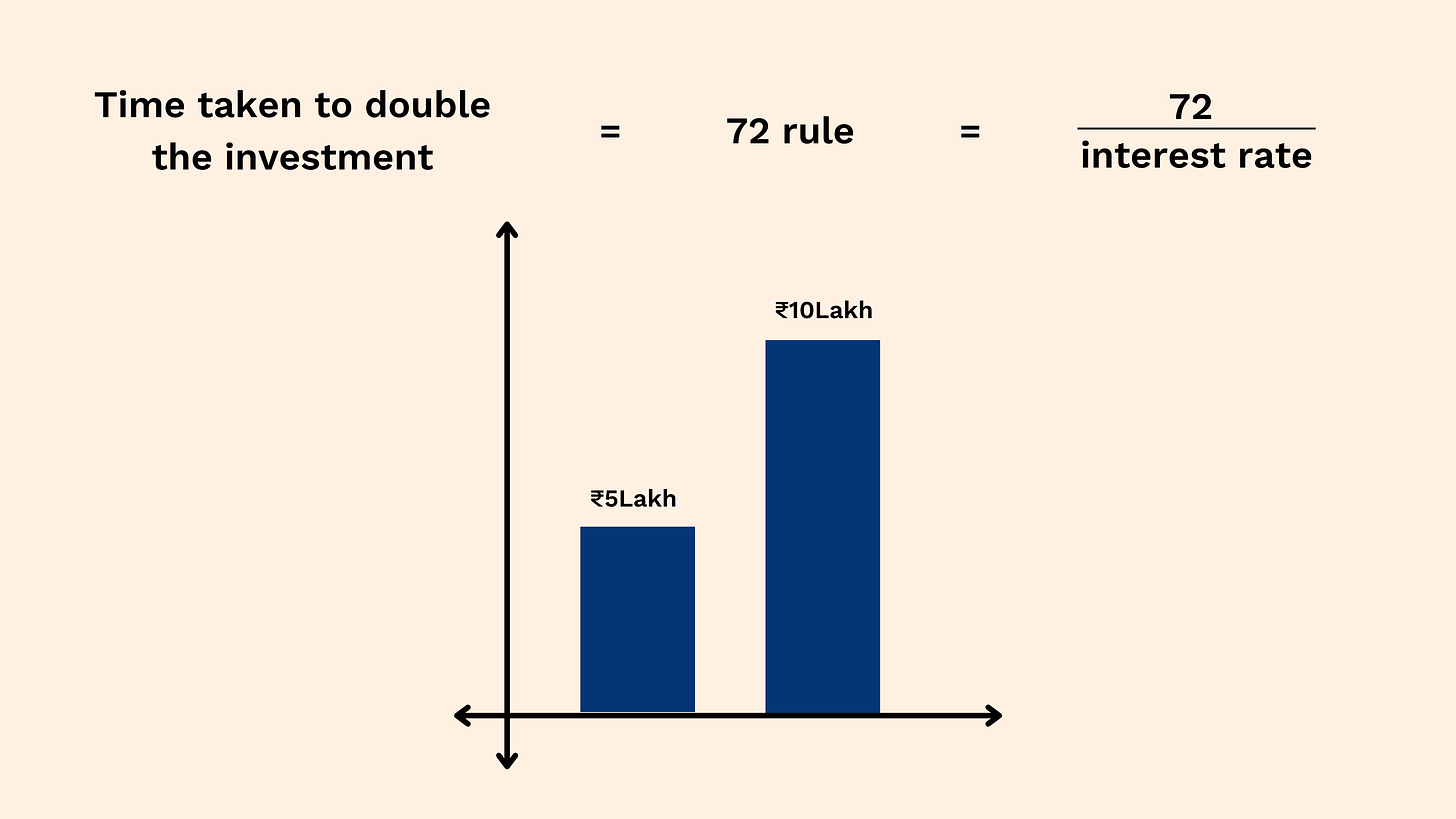

The 72 rule

It’s a simple way to determine how long an investment will take to double, given a fixed annual rate of interest. The number of years needed to double your money can be calculated by dividing 72 by the interest rate.

Let’s have an example, if the gross domestic product (GDP) grows at 4% annually, the economy will be expected to double in, 72 / 4% = 18 years.

How does this affect you?

Always make on-time, full payments on all your debts to avoid compound interest. Start your investments and savings early to give your money more time to develop.

Compounding benefits and drawbacks

BENEFITS:

It makes a sum of money grow at a faster rate than simple interest.

It helps you out with your investments and be a significant contributor to wealth accumulation

It helps to counteract wealth-eroding elements like rising living expenses, inflation, and declining buying power.

Compound interest profits are obviously taxable unless they are kept in a tax-sheltered account. It is typically taxed at the regular rate determined by your tax bracket, and your balance may decrease if the investments in the portfolio lose value.

One of the simplest ways for investors to gain from compound interest is through mutual funds. When dividends from a mutual fund are chosen to be reinvested, more shares of the fund are bought. The cycle of buying more shares will keep the investment in the fund growing in value as more compound interest accumulates over time.

DRAWBACKS:

It can sometimes be more expensive than you realize.

The cost of compound interest is not always immediately apparent.

If you do not manage your investment closely, making interest payments can lose you money.

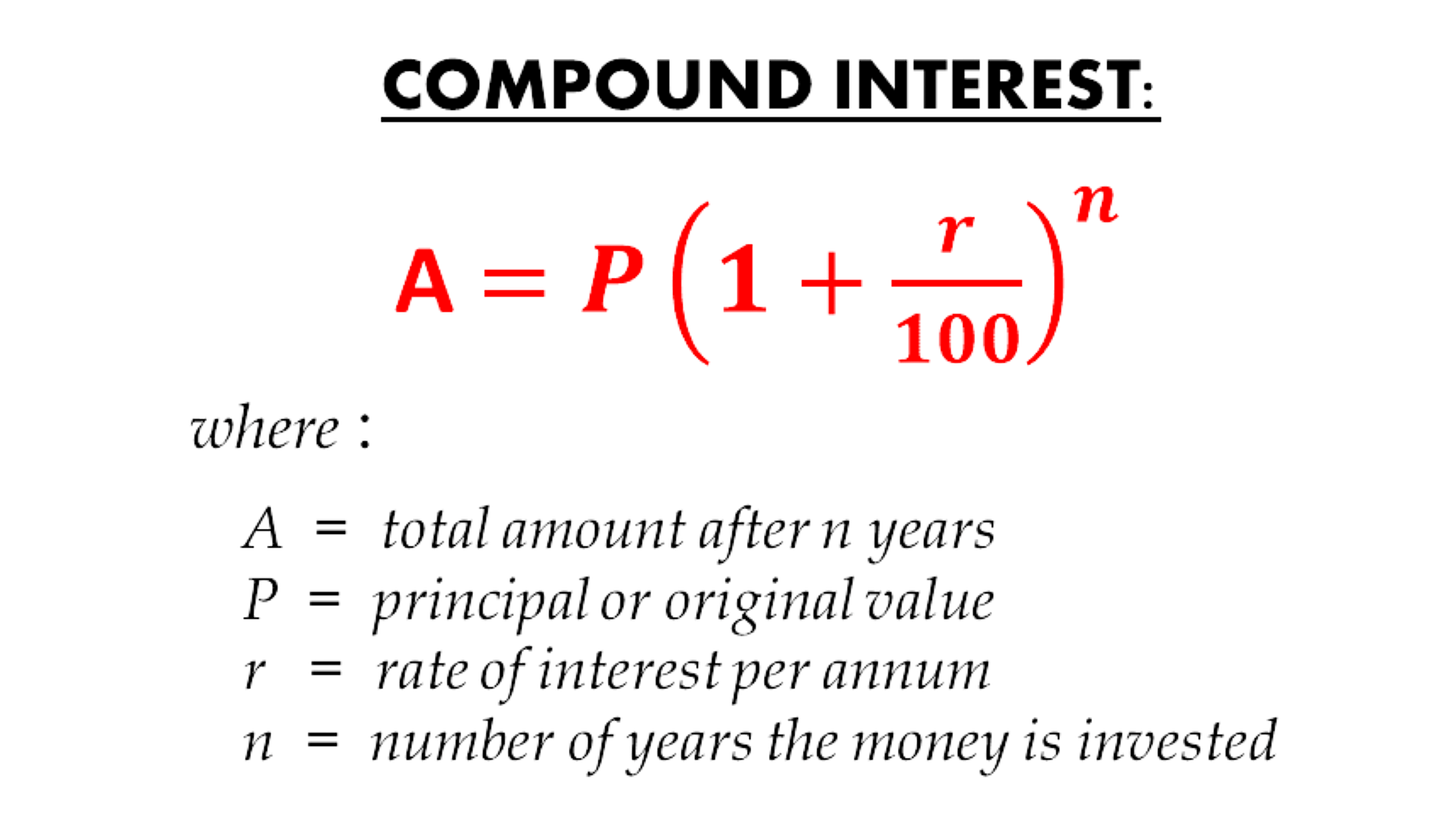

Calculation of Compound Interest:

Compound interest is calculated by multiplying the initial principal amount by one, plus the annual interest rate, raised to the number of compound periods, minus one. When calculating compound interest, the number of compounding periods makes a significant difference. The higher the number of compounding periods, the greater the compound interest. Because compound interest includes interest accumulated in previous periods, it grows at an ever-accelerating rate.

How to use Compounding to grow your money fast-

To take maximum advantage of compounding, just follow next three easy, wealth-building rules.

1. Focus on savings in the first 10 years : When you’re younger, it’s not so much about the type of investments you hold but more about just diligently saving.

“Mutual funds or stocks? It just doesn’t matter much at this stage”, “Simply having a savings account means you’re in the game.”

In these early years, just celebrate the fact that you actually have money and are growing your wealth in a disciplined way. “You’re ahead of a lot of people,”

2. Be patient : As the rule says itself, keep patience, no hurry, no rush! Investment returns matter more towards the end of your saving years. So, while compounding is a powerful tool, decent outcomes from compound interest need a very long time to appear-often more than 25 years.

In later years you’ll see big gains from focusing on lowering investment costs and sticking with a good investment strategy. That’s when it will pay off most.

3. Don’t forget to invest in yourself : Of course, saving money is great and so is investing well for the long haul, but don’t miss out on the great monetary returns you can get by simply investing in yourself. Take professional courses and develop skills that will qualify you for jobs and careers that are financially and personally rewarding and that can up your salary significantly as you get older. Oftentimes, building a career you love can offer the best dividends-both personally and financially.”