The world of freelance work in India is expanding dramatically, with millions of individuals embracing the flexibility and freedom of project-based work. However, for these independent earners, tax season can be a source of confusion and stress. That's why this comprehensive guide is here to help demystify the Income Tax Return (ITR) filing process for freelancers so they can easily navigate the system.

It is of utmost importance to have a clear understanding of one's tax obligations in order to maintain financial stability, regardless of whether one is an experienced web developer or a budding content creator. This guide aims to provide freelancers with a comprehensive understanding of tax filing by explaining complex tax terminologies, offering insights on expense deductions, and providing guidelines on selecting the appropriate ITR form. Equipped with this essential knowledge, freelancers can maximise tax efficiency while minimizing potential liabilities.

If you're a freelancer looking to take control of tax season and maintain a positive relationship with the authorities, then join us on this informative journey. We're here to support you in your tax endeavours!

Freelancing & Income Tax: The Basics

According to the Income tax laws in India, any income earned by an individual using their manual or intellectual skills is classified as “profit and gains from business and profession.” From a tax perspective, freelancing is considered a business and profession. Freelancers include various consultants and professionals, such as blog consultants, software developers, content writers, web designers, tutors, and fashion designers. Filing income tax as a freelancer may be slightly complicated due to income coming from multiple sources.

Identifying Your Income Streams

As a freelancer, your income isn't confined to a singular paycheck. Here are some common income streams to be aware of:

Project Fees: This constitutes the core of your earnings, encompassing payments received for delivering specific projects or services for clients.

Service Charges: Certain freelance work, like consultancy or technical services, might involve additional service charges beyond the core project fee.

Royalties: If your work involves intellectual property rights, such as writing ebooks or creating music, royalties earned from ongoing sales should be included in your income.

Interest Income: Earnings from any interest-bearing investments, like fixed deposits or debt instruments, also need to be factored into your total income.

Other Income: This category encompasses any other income you receive, such as referral fees or prize money from competitions.

Applicability of ITR and Distribution of Tax Slabs for Freelancers

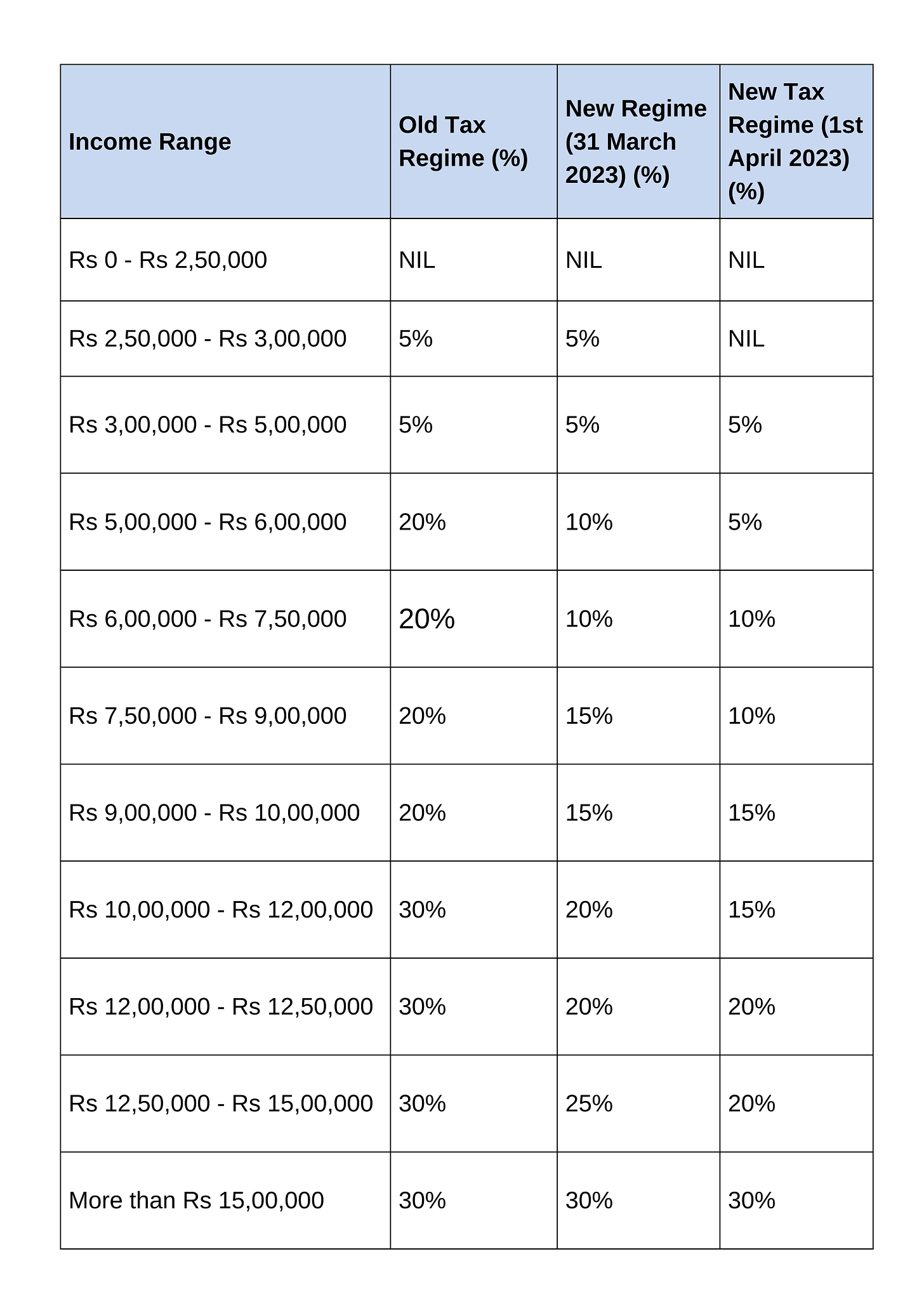

As a freelancer in India, it's important to be aware of the taxes and regulations that apply to your work. You'll be subject to both Income Tax and GST (Goods & Services Tax). If your annual turnover exceeds Rs. 20 lakhs (Rs. 10 lakhs for North Eastern and Hill states), you'll need to register under GST. While the standard GST rate is 18%, this may vary depending on the nature of your services.

It's also important to pay attention to your income tax obligations. For freelancers under 60 years of age, there are different tax rates that apply. However, with the right guidance and advice, managing your taxes can be a straightforward process. We're here to help you navigate the system with confidence and ease, so you can focus on what you do best - delivering high-quality services to your clients.

Freelancers have options to choose from different tax regimes that allow them to claim tax deductions. A Presumptive Taxation Scheme under Section 44ADA of the Income Tax Act, 1961 is available for freelancers, which enables them to pay tax on only half of their gross annual income, provided that their total income for the year is less than Rs. 50 lakhs. However, if the gross annual income exceeds Rs. 1 crores, a tax audit for business income is mandatory.

In cases where a freelancer makes a payment to professionals that exceeds Rs. 30,000 (aggregate during the financial year), TDS is applicable at a rate of 10%. Freelancers can utilize the ITR-4 form to file income tax returns under the Presumptive Taxation Scheme. Alternatively, if freelancers do not wish to make use of the benefits of the Presumptive Taxation Scheme, they can file their returns using the ITR-3 form, which is applicable for income from business or profession.

Additional Expense Deductions

Freelancers can claim various business-related expenses as deductions to reduce their taxable income. Common deductible expenses include:

Office Supplies: Costs of items such as stationery, software subscriptions, and computer accessories.

Travel Expenses: Costs incurred for business-related travel, including transportation, accommodation, and meals.

Professional Fees: Payments made to accountants, lawyers, or consultants for professional services.

Internet and Phone Bills: Expenses for internet and phone usage that are necessary for conducting business.

Marketing and Advertising: Costs related to promoting your freelance services, such as website maintenance, online advertising, and promotional materials.

This Freelancer Tax Guide Has You Covered (Literally, We'll Do the Taxes)

You've spent hours hunched over your computer screen, surrounded by forms and crossed-eyed from calculations. Yet, a nagging sense of doubt persists. Is everything filled in correctly? Are you missing something crucial? A tax professional can offer a sanity check, ensuring your ITR is filed accurately and putting your anxieties to rest (well, most of them).

Now, we may not be able to turn tax season into a picnic in the park, but at JJ Tax, our team of experienced tax professionals is dedicated to making the process as smooth and efficient as possible. Whether you need guidance with deductions, help with ITR filing, or simply someone to answer your tax-related questions, we're here to support you.

So, if you're a freelancer seeking a helping hand with your taxes, feel free to contact us at JJ Tax. We'll be happy to chat and we're here to turn your tax woes into woohoos!