Taxation is an important aspect of personal finance, be it for a resident or a Non-Resident. However, when you get into the details, you’ll find out that taxation for NRIs is different and can be quite confusing. Before getting into the details of NRI Income Tax, it is important to determine whether an individual is a resident or Non-Resident for the year.

Who qualifies as an NRI?

An individual is considered an Indian resident for a financial year if they satisfy any of the two conditions:

He/she is in India for at least 182 days (6 months approximately) during the financial year

He/she has been in India for 60 days in the previous year and he/she was in India for 365 days during the last 4 years.

The same applies to a Person of Indian Origin (PIO) who visits India. The second condition does not apply to these individuals. A PIO is a person whose parents or any of his grandparents were born in undivided India.

If you do not meet any of the above conditions, you are a Non-Resident Indian.

Calculation of Non-Resident’s Total Income

India taxes any revenue that is earned, derived from, or comes from a source within the country.

Income from Salary:

Your salary income will be taxable in India under the following two conditions:

If you are an NRI and you received a salary in India straight into your Indian bank account or someone else received it on your behalf in India, then the salary income will be taxed in India.

If you received a salary for work performed in India, it is considered to have been earned in India. As a result, if you are an NRI and you received pay for the services you provided in India, India will have to tax you on it.

NRIs have to pay income tax in accordance with their tax bracket. The income tax slab rates for NRI taxpayers are the same as those for resident taxpayers.

Income from House Property

An NRI has to pay taxes on the income from any Indian residential property that is either rented out or left empty The income will be taxable in India regardless of whether they get the residential property income straight into the non-resident's account outside of India or in their NRE account. This is so because the property, which is the source of the income, is situated within of India.

NRI taxpayers have the same tax benefits as resident taxpayers, including:

a basic deduction of 30%;

a deduction for municipal taxes;

the advantage of an interest deduction for house loans; and

Using Section 80C to deduct the loan's principal repayment. Additionally, under Section 80C, you may deduct the stamp duty and registration fees you paid when buying a new home.

Income from Business & Profession

An NRI must pay taxes on any income received from a business they establish, operate, or manage in India. The revenue from businesses and professions must be taxed according to the applicable income tax bracket.

Income from Other Sources

Any income received by an NRI in the form of interest on fixed deposits and savings accounts must be reported to India for tax purposes. The interest that an NRI receives in his NRE and FCNR accounts, is tax-free. However, any interest they get in their NRO account will be fully taxable.

Income from Capital Gains

All capital gains that result from the transfer of capital assets that are physically located in India are subject to local taxation. Capital gains on investments made in equities or debt instruments in India will also be taxed there.

However, TDS must be paid at the following rates in case of sale of a house property:

20% in case of long-term capital gains

30% in case of short-term capital gains (held for less than 2 years)

NRIs are eligible to claim tax exemption under Sections 54, 54EC, and 54F on the LTCG on the sale of a residential property, just like residents.

Advance tax for NRIs

An NRI must pay the advance tax if their tax liability for the preceding fiscal year exceeded Rs 10,000. Interest will be levied in case of non-payment.

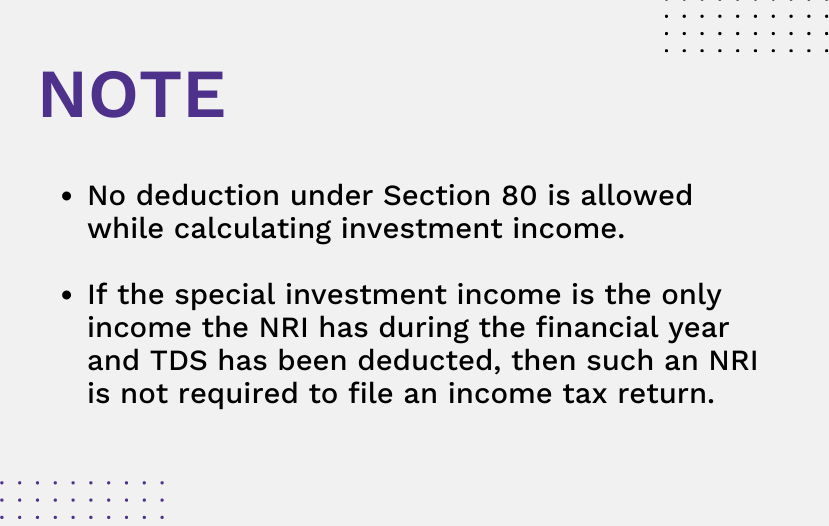

Investments that Qualify for Special Treatment

An NRI may benefit from favorable tax treatment with regard to certain investments.

The following are “specified assets” for this purpose:

Shares of an Indian company (public or private)

Debentures issued by a publicly traded Indian company.

Deposits with banks and public companies.

Any security of the central government.

Such other assets as specified by the Central Government for this purpose in the official gazette.

Tax Deductions for NRIs

NRIs are eligible to claim various deductions and exemptions from their total income just like residents. A few such deductions are:

Deductions under Section 80C -

Payment of life insurance premium for himself, spouse, or a child. The premium must be less than 10% of the sum assured.

Payment of tuition fees for the full-time education of any two children is paid to any institution in India.

Repayment of home loan principal -

Investment in ULIP and ELSS

Deduction under Section 80D

NRIs are allowed to claim a deduction up to Rs. 25000 in respect of health insurance premiums paid for self, spouse, and dependent children. In addition, an NRI can also claim a deduction for parent’s insurance (father or mother or both) up to Rs 25,000.

For preventive health examinations, a deduction of up to Rs. 5000 is available.

Deduction under 80E

Deduction of interest paid on an education loan for the higher education of oneself, one's spouse, one's children, or a dependent student is permitted for NRIs under Section 80E, subject to the earlier of a period of eight years or until the interest is paid. The amount of interest has no upper limit.

Deductions under 80G

NRIs are eligible to claim a deduction for donations made under Section 80G of the Income Tax Act.

Deduction under 80TTA

NRIs are permitted to claim a deduction of up to INR 10,000 on income from interest on savings bank accounts.

Deduction from House Property income

Deduction towards property tax paid and interest on home loan (up to Rs. 2 lakhs) is allowed to an NRI.

The Bottom Line

The rules for NRIs are slightly different and complicated as compared to resident Indians. It would be a good idea to comprehend the tax policies related to NRI taxation and make the most of the tax benefits available to you.