A Comprehensive Guide For An Investor⭐

In the ever-shifting landscape of financial markets, one thing remains constant: the quest for secure and liquid investments. These funds have consistently performed well, offering investors a safe haven for their capital while providing competitive returns.

Whether you’re a seasoned investor or just starting your investment journey, this newsletter is designed to provide you with valuable insights into the dynamic world of liquid funds.

What are Liquid Funds?

Liquid funds, often called cash-equivalent or money market funds, are an important component of the mutual fund landscape. They offer a unique blend of safety, liquidity, and moderate returns.

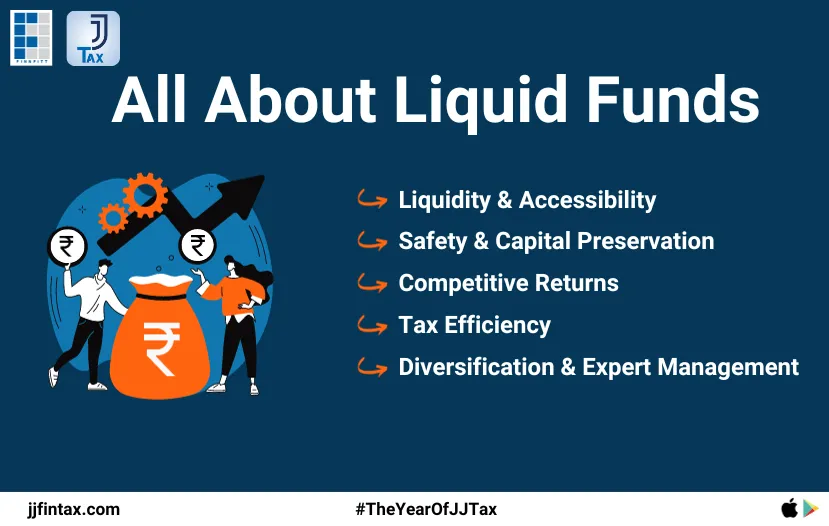

Liquidity & Accessibility:

Invest in short-term debt instruments.

No lock-in period, providing easy access to funds.

Safety & Capital Preservation:

Prioritize low-risk, highly-rated debt securities.

Focus on protecting capital.

Competitive Returns:

Aim for modest, competitive returns.

Interest earned on debt securities drives returns

Tax Efficiency:

Short-term capital gains for holdings under three years.

Indexation benefits for longer-term holdings.

Diversification & Expert Management:-

Professional fund managers actively oversee portfolios.

Pooling resources for diversification benefits.

Liquid funds are versatile tools suitable for various financial needs, whether it's an emergency fund or optimizing short-term investments. Ensure alignment with your goals, risk tolerance, and investment horizon when choosing a liquid fund.

A few examples of top Liquid Funds in India may include Navi Liquid Fund , Mirae Asset Cash

Management Fund , Quant Liquid Direct Fund….

A good Liquid Fund must have a

track record of stability& Consistent returns and a diversified mix of short-term debt

securities.

One standout feature of these liquid funds is their flexibility. With no lock-in period, investors retain the freedom to redeem their investments at any time, and after a mere six days from the date of purchase, there are no exit loads to worry about.

Liquid funds play a pivotal role in any well-rounded investment strategy. They are a safe haven for your idle cash, offering liquidity, safety, and competitive returns. Whether you need a parking place for your emergency fund or seek to optimize the returns on your short-term investments, liquid funds can be an ideal choice.

As with any investment, assessing your financial goals, risk tolerance, and investment horizon is crucial before choosing a liquid fund. Consulting with a financial advisor can help you select the right fund that aligns with your specific needs.

At JJ Tax, we are here to assist you in navigating the world of finance and ensuring that your choices are well-informed and strategically sound.

Stay tuned for more insights on optimizing your investments and securing your financial future.

P.S - Apologies for the delay in newsletter - our festive hangover extended longer than expected😅