Learn the facts about GST!!!

Ever wondered if you're paying too much GST, or if you even need to register at all? Maybe you've heard conflicting advice about claiming tax credits, or filing deadlines. Fear not, fellow JJ Tax users! This newsletter is your one-stop shop to busting common GST myths and separating fact from fiction. Grab a cup of chai (it's tax-deductible...maybe?), and get ready to navigate the world of GST with confidence!

To kick things off, let's see if we can sort GST fact from fiction with a fun little quiz. Consider it a warm-up for your tax knowledge muscles. So put on your thinking cap and get ready to test your GST IQ! (Don't worry, even if you miss a few, the answer reveals will have you feeling like a GST pro in no time.) For those of you joining us through the audio version, simply test yourself mentally – we'll be revealing the answers and explanations throughout this information-packed newsletter.

Ignorance Isn't Bliss, It's Penalties! Ready to separate fact from fiction? Put your GST knowledge to the test with our GST MythBusters Quiz!

For each question, choose the answer you believe is true. We'll reveal the answer and explain the real deal behind the myth afterwards. So, grab a pen and paper (or keep scrolling!), and let's bust some GST myths!

Myth #1: If my business turnover is below the registration threshold, I don't need to worry about GST.

A) True

B) False

Answer: (B) False

Even if your business turnover falls below the registration threshold, you might still need to register for GST under certain circumstances. These include persons making inter-state taxable supplies (except few exemptions), Casual taxable persons making taxable supplies, Persons who are required to pay tax under Reverse charge, Electronic Commerce operator, non-resident taxable person making taxable supply, and many more.

Myth #2: Can we claim ITC on purchase before registration?

A) True

B) False

Answer: (B) False

Only after obtaining the GST registration, taxpayers can avail input tax credit of GST paid on such inputs, capital goods and inputs in finished goods lying in stocks, from the effective date of obtaining registration.

Myth #3: GST registration is a complex process, and I need to hire a professional.

A) True

B) False

Answer: (B) False

The GST registration process has been simplified considerably. You can register online through the government portal in a few simple steps. However, if you have specific complexities or require guidance, consulting a professional is always recommended.

Myth #4: I can't claim ITC for travel expenses incurred for my business.

A) True

B) False

Answer: (B) False

You can claim ITC on travel expenses incurred for your business, subject to certain conditions. These include the purpose of travel being related to your business and having proper documentation to support the claim. Further, ITC is also not available in case of travel and benefits extended to employees on vacation such as leave or home travel concession.

Myth #5: GST filing needs to be done only once a year.

A) True

B) False

Answer: (B) False

Generally, a regular business has to file 2 monthly returns (GSTR-1 & GSTR-3B) and 1 annual return (GSTR-9), thereby making a total of 25 GST returns in a year.

That wraps up our fun MythBusters Quiz! So, how did you score? Did you learn something new?

Now that we've tested your GST knowledge, let's delve deeper into some of the most common GST myths and separate fact from fiction:

Myth: You can only claim Input Tax Credit (ITC) on the GST you pay for purchases.

Fact: ITC can be claimed on various indirect taxes paid on business-related purchases.

Myth: GST registration is a complex process requiring professional help.

Fact: The process is simplified for online registration through the government portal. However, consulting a professional is recommended for complexities.

Myth: There's no difference between CGST and SGST.

Fact: CGST is tax collected by the central government, and SGST is collected by the state government. For intra-state transactions, both CGST and SGST apply.

Myth: Exporting goods is exempt from GST.

Fact: Zero-rated GST applies to exports, but businesses need to file returns to claim the ITC on taxes paid on inputs used for export goods.

Myth: GST has increased the prices of all goods and services.

Fact: While some prices might have risen due to various factors, GST has also led to a reduction in tax burden for items.

Myth: You have to pay tax twice if the transaction is done by credit card.

Fact: You only pay GST once irrespective of the payment method (cash, credit card, etc.).

Myth: Computerized billing with internet connectivity is mandatory under GST.

Fact: While filing returns might require internet access, manual billing is still allowed.

Myth: There's no need to register under GST if you sell previously owned items.

Fact: Registration might be required depending on the nature of the item and whether you're a registered dealer or not.

Myth: GST applies to agricultural income.

Fact: GST doesn't apply to income generated through agricultural activities and produce from agriculture, including dairy, served fresh without processing.

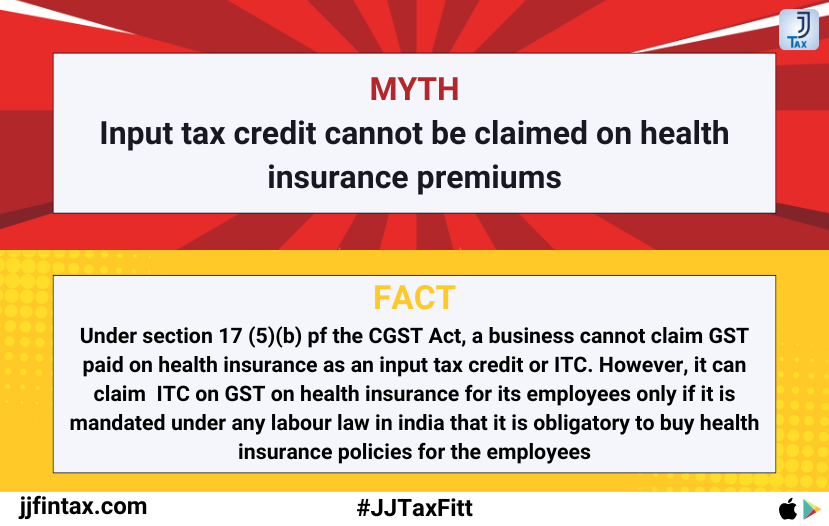

Myth: Input service tax credit can be claimed on rent for a business place.

Fact: ITC can be claimed on rent for premises used for business purposes, subject to certain conditions. The owner of the property (which is given on rent) has to collect the GST from the person paying rent. GST on the rent charged for immovable properties by the government or local authority to a registered person will be under Reverse Charge Mechanism.

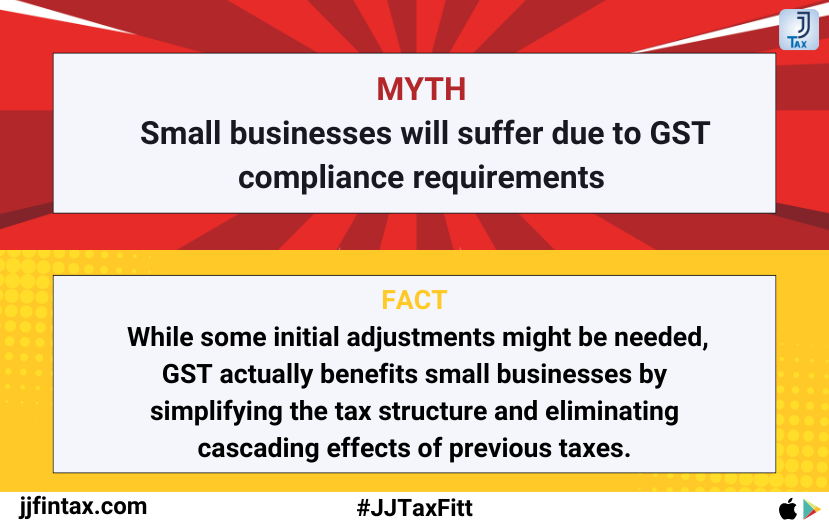

Myth: Only large companies can benefit from GST.

Fact: GST can benefit businesses of all sizes by streamlining the tax structure, reducing compliance burden, and creating a level playing field.

Myth: You can revise GST returns once filed.

Fact: A return once filed cannot be revised under GST. Any mistake made in the return can be rectified in the GSTR-1 filed for the next period (month/quarter).

Myth: Only a physical shop needs to register under GST.

Fact: Businesses operating online or through e-commerce platforms also need to register under GST especially if their turnover exceeds the threshold.

Myth: Input tax credit cannot be claimed on discounts offered to customers.

Fact: Discounts given before or at the time of supply are to be mentioned in the invoice separately. However, the discounts that are given after the supply is made are allowed as a deduction if an agreement between the supplier and the recipient was made and can be linked to the relevant invoice.

Myth: GST registration requires a separate bank account for business transactions.

Fact: There's no requirement to maintain a separate bank account for GST purposes, but do note the functional account should be a Current Account.

Myth: Penalties for GST non-compliance are very harsh.

Fact: While penalties exist for non-compliance, the government offers various amnesty schemes and strives to make the process more taxpayer-friendly.

Myth: Free samples or gifts need to be included in GST returns.

Fact: Free samples or gifts of negligible value typically don't need to be included in GST returns. Since the free samples are not supplies, there is no requirement of disclosing the same as outward supplies in the returns. Hence the ITC would need to be reversed on the goods circulated as free samples.

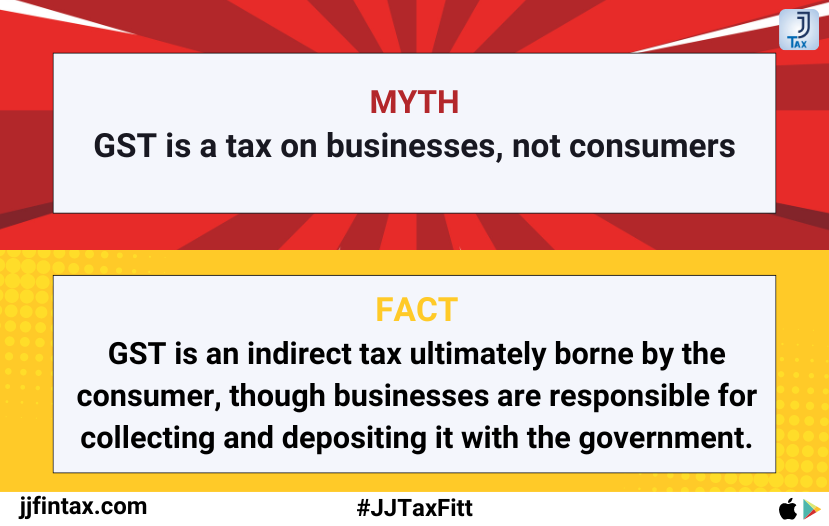

Myth: GST affects only the manufacturing sector.

Fact: GST applies to a broad spectrum of businesses, including those in the service sector, trading, and manufacturing.

Myth: Input tax credit cannot be claimed on donations or sponsorships.

Fact: Input tax credit (ITC) for the GST paid can be claimed by Section 16 of the CGST Act, 2017 if these services are acquired for business purposes or taxable supplies.

You can breathe a sigh of relief, because baffling GST riddles are behind you. At JJ Tax, we're a team of tax whizzes passionate about empowering businesses with clear and concise GST guidance. Whether you need assistance with registration, filing returns, or navigating tricky tax situations, our experts are here to help.

Visit our website or download our app to learn more about the comprehensive GST services and breathe easy knowing you have tax superheroes on your side!

GST decoded; worries eroded! See you around next time.

Stay compliant, stay informed, and stay ahead — with JJ Tax by your side.